Standing orders are the instructions set up in advance to make payments against invoices raised by the supplier.

Standing order for invoice payments reduces the manual intervention required by the client user to make the payments. It makes the invoice payment process more reliable for corporates.

This feature also minimizes the over dues possibility on seller loans against any invoice.

![]() Making a payment using Pay Now option

from batch actions results in raising the full amount payment request,

whereas, using Pay Now option from Select dropdown allows

you to raise either partial or full payment against any invoice or PO.

Making a payment using Pay Now option

from batch actions results in raising the full amount payment request,

whereas, using Pay Now option from Select dropdown allows

you to raise either partial or full payment against any invoice or PO.

1. Navigate to SCF.

2. Click Invoice Payment Stdg Order. The Invoice Payment Stdg Order page is displayed.

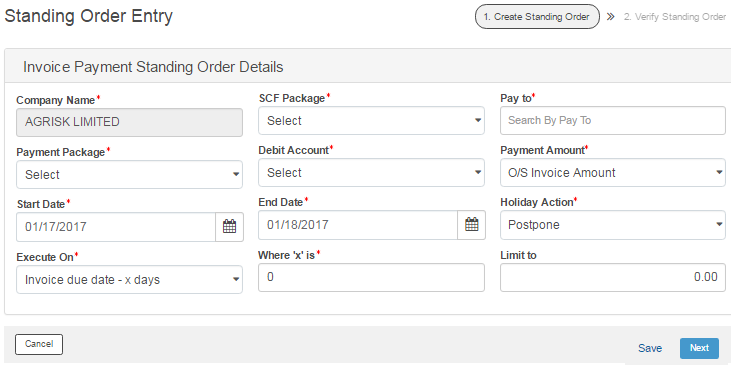

3. Click Create Standing Order. The Standing Order Entry page is displayed.

4. The Company Name is auto-displayed for a user having single company access rights. A user having access rights to multiple company can choose from the list of applicable companies.

5. Select the required SCF Package.

6. Specify the supplier name in the Pay to field.

7. Select the required Payment Package.

8. Select the Debit Account to pay from.

9. Specify the Payment Amount. The available options are:

• O/s Invoice Amount: This allows the payment against the invoice, till the Invoice outstanding amount.

• O/s Seller Loan amount: This allows the payment against the invoice to the extent of the total outstanding loan amount of seller.

10. Specify the Start Date and End Date to mark the beginning and ending of the standing order.

11. Select the Holiday Action. The available options are:

• Prepone: Instructs the bank to debit the account a day prior to the holiday.

• Postpone: Instructs the bank to debit a day later in case the standing order execution date falls on a holiday.

![]()

Consider the below scenario where Current Date: 11/12/2014. The bank user marks 12/12/2014 in bank admin on 11/12/2014.

Now if a Standing Order is defined to get executed on 12/12/2014, with the Holiday Action as Prepone, it still gets executed on 13/12/2014.

12. Select the required Execute On date from the drop-down. The available options are:

• Invoice due date - x days: Instructs the bank to make payment against an invoice 'x' days before the due date of payment. Specify days in Where 'x' is field.

• Invoice due date + x days: Instructs the bank to make payment against an invoice 'x' days after the due date of payment. Specify days in Where 'x' is field.

• Specific day of each month: Instructs the bank to make the payment against an invoice on a specific day of the month. Specify the day of the month in Day field.

![]()

· If the bank is financing the seller against the Invoice till the Invoice due date, it is advised to select Invoice Due Date – X Days, so that the Invoice gets paid on or before invoice due date, and the seller loan is recovered, before it becomes overdue.

· Standing orders with frequency as Specific day of each month, system automatically selects invoices which are outstanding and are due or past their due date and no other standing instruction is initiated against these.

13. The Limit To field indicates the maximum loan repayment amount up to which Fusion Cash Management automatically generates a payment instruction against the invoice on the specified date. Specify the required value.

14. Click Save to save the changes.

15. Click Next to verify and submit the standing order for approval.

| © 2017-19 Finastra International

Limited, or a member of the Finastra group of companies (“Finastra”).

All Rights Reserved.

Cat ID: FCM4.6-00-U02-1.5.3-201903 |