Liquidity Management System (LMS) enables you to manage short-term liquidity, which is a prime objective of a corporate treasury. A conglomerate usually has multiple accounts across multiple banks for operations that are diversified into a range of product and service lines.

Each of these product divisions and geographical regions has its own cyclical demand and supply, credit and payment patterns. These intricacies result in complex portfolio of cash flows with offsetting or overlapping effects.

Using LMS, a corporation can efficiently manage a network of accounts and credit facilities across multiple banks and financial institutions in various countries to achieve the following objectives:

• Obtain single window visibility for balances and transactions across all bank accounts and optimize their liquidity positions.

• Reduce net borrowings across the corporation - to save interest costs and avoid unnecessary deficits.

• Deploy available surpluses to generate additional income.

• Ensure funds availability by synchronizing mismatches between inflows and outflows.

![]()

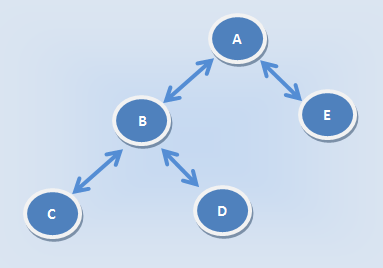

· You hold multiple accounts with Standard Bank, say A, B, C, D, and E at various locations.

· You need the flexibility to transfer funds within these accounts to manage your operational needs.

· LMS enables you to move funds within these accounts as per the agreements and defined frequency.

· The adjacent graphic illustrates a sample movement of funds between accounts: A, B, C, D, and E.

LMS enables you to achieve your liquidity requirements using:

• Sweeps

• Notional Pooling

| © 2017-19 Finastra International

Limited, or a member of the Finastra group of companies (“Finastra”).

All Rights Reserved.

Cat ID: FCM4.6-00-U02-1.5.3-201903 |