Gross structure is a method of combination, in which the gross credit and debit balances are used to determine the interest applied on the pool or group. The bank interest earned or paid for the pool is determined by this gross credit or debit balances of the pool respectively.

For a gross structure, the pool receives and pays bank interest simultaneously.

For a gross structure, the accounts and sub-groups in the structure with credit balances contribute to the gross credit balance at the next higher hierarchy and receive credit apportionment from the paired node.

The accounts and sub-groups in the structure with debit balances contribute to the gross debit balance at the next higher hierarchy and receive debit apportionment from the paired node.

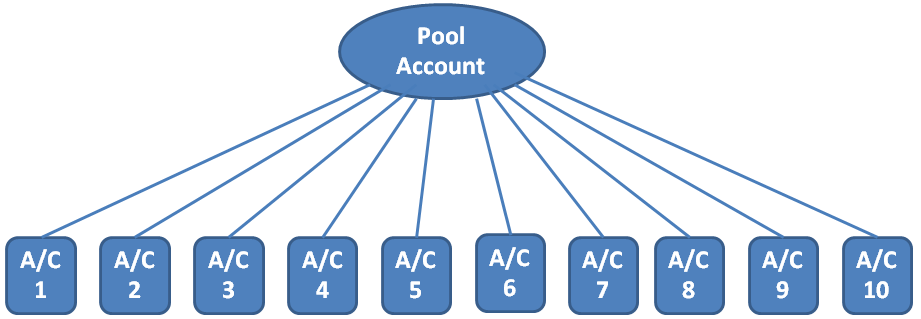

A sample gross structure is illustrated below:

Assume the daily balances as mentioned in the following table:

Account |

A/C 1 |

A/C 2 |

A/C 3 |

A/C 4 |

A/C 5 |

A/C 6 |

A/C 7 |

A/C 8 |

A/C 9 |

A/C 10 |

Balance |

- 450000 |

200000 |

300000 |

- 250000 |

350000 |

- 350000 |

200000 |

- 600000 |

300000 |

200000 |

The interest rates, pool balances, and corresponding interest amounts are calculated in the following table:

Node |

Gross Credit Balance |

Gross debit balance |

Credit interest rate |

Credit interest amount |

Debit interest rate |

Debit interest amount |

Pool |

15,50000.00 |

-16,50000.00 |

3.0000% |

127.40 |

2.6500% |

-119.79 |

However to determine the benefit derived by operation of notional pool on gross structure, assuming that accounts receive and pay interest at the respective level, the benefit would be derived as under:

Account |

Balance |

Applicable Interest rate |

Applicable Interest Amount |

Account 1 |

-450000 |

2.7500% |

-33.90 |

Account 2 |

200000 |

2.7500% |

15.07 |

Account 3 |

300000 |

2.7500% |

22.60 |

Account 4 |

-250000 |

3.0000% |

-20.55 |

Account 5 |

350000 |

2.5000% |

23.97 |

Account 6 |

-350000 |

3.0000% |

-28.77 |

Account 7 |

200000 |

2.5000% |

13.70 |

Account 8 |

-600000 |

3.0000% |

-49.32 |

Account 9 |

300000 |

2.5000% |

20.55 |

Account 10 |

200000 |

2.7500% |

15.07 |

Therefore, the interest earned or paid by a client using gross structure in notional pooling is calculated in the following table:

Credit |

Debit |

|

Applied Pool interest |

127.40 |

-119.79 |

By operation of the notional pool for the day, the client earns Credit interest of 127.40 and Debit interest of -119.79.

| © 2017-19 Finastra International

Limited, or a member of the Finastra group of companies (“Finastra”).

All Rights Reserved.

Cat ID: FCM4.6-00-U02-1.5.3-201903 |