An agreement indicates a contract between a client and the bank for executing sweeps. The bank creates such agreements and you can perform the required activities on these agreements using Liquidity Management System (LMS).

The key features of a sweep agreement are:

• A client can have more than one agreement with the bank.

• Each agreement can have multiple account pairs for transfer of funds within these pairs.

• Funds are moved from the participating account to contra account based on factors and conditions, such as the minimum account balance, fill deficit (from contra account to participating account, if the participating account is in deficit), movement condition, limits, and current balance.

1. Navigate to Liquidity.

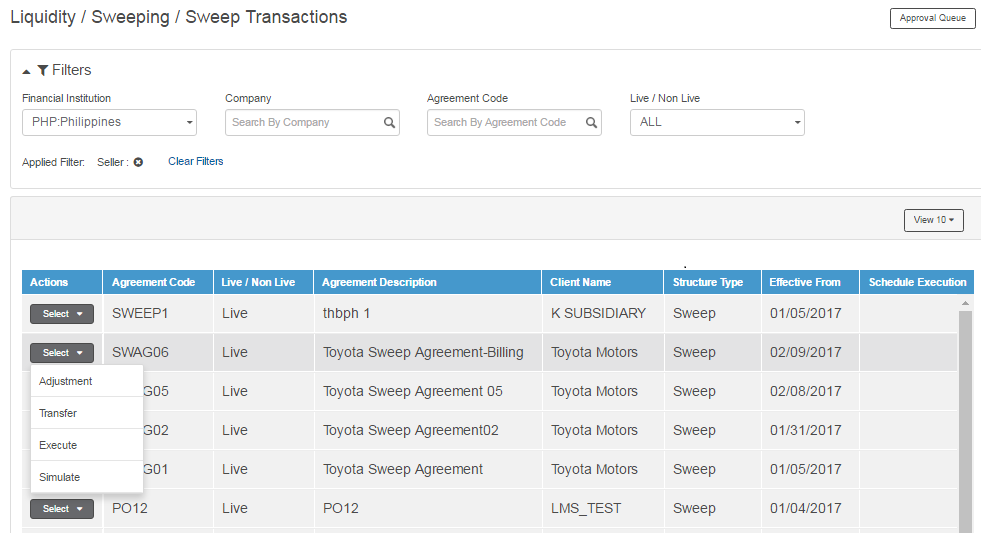

2. Click Sweeping >> Sweep Transactions. The Sweep Transactions page is displayed.

3. You can perform the following functions using Sweep Transaction page:

![]() Cancelling a sweep

agreement schedule

Cancelling a sweep

agreement schedule

Page element |

Description |

Filters |

Use the following filters to narrow down your search for sweep agreements: • Company: Specify the company name. • Agreement Code: Specify the agreement code or name. • Live/Non Live: Select Live or Non Live statuses as required. • Structure Type: The available options are All, Sweep, Flexible, and Hybrid.

To clear the applied filters, click Clear Filters.

|

Select dropdown |

You can perform the following actions on an agreement: • Adjustment: Adjustment feature is enabled only for those agreements for which the Manage Inter Account Position feature is enabled. The Adjustment feature enables you to adjust the inter account position for an account pair for an agreement in Liquidity Management System. Such entries are not posted to the host system. • Transfer: Transfer feature enables you to re-run a particular movement from an agreement between an account pair, if the movement failed to generate due to any reason. In this case, LMS does not generate balance requests and you must specify balance for the transaction. After the transfer is authorized, the entries are handed off to the host system for posting. • Execute: Execute feature is available only for agreements with the Allow On Demand feature enabled. While executing an agreement, you must select the required balance type (Available or Book Balance), whenever required. In this case, LMS generates balance requests upon approval. Upon receiving balance response based on the movement conditions the movement transactions are generated, and the entries are handed off to the host system for posting. • Simulate: Simulate feature is available only if it is enabled while on-boarding the client. You can simulate agreement execution by specifying the balances for the accounts participating in the agreement, without posting the details to the core banking system. This feature does not need any authorization. • Cancel Schedule:This option enables you to cancel the execution of any scheduled agreement. The summary grid on the page displays the next scheduled execution, based on the current application date. To cancel the next scheduled execution, select the required agreement and click Cancel Schedule. After approval, the agreement is not executed for the cancelled schedule. |

Pagination bar |

Depending on the volume of data displayed in the list, the list can have one or more pages. You can navigate through the page by using the pagination bar. |

Approval Queue |

Any action taken on an agreement (such as adjustment, transfer, execute, and cancel schedule) that requires approval, must be approved in Fusion Cash Management before the transaction is processed. Click Approval Queue to view the transactions requiring approval. The checker user can approve, reject, and view maker history of these transactions. |

View |

Click to see or set number of records on a single page. |

Grid |

The grid displays a list of existing sweep agreements or displays agreements based on the chosen filter criteria. |

![]() Cancelling

a sweep agreement schedule

Cancelling

a sweep agreement schedule

| © 2017-19 Finastra International

Limited, or a member of the Finastra group of companies (“Finastra”).

All Rights Reserved.

Cat ID: FCM4.6-00-U02-1.5.3-201903 |