• Company Details

• Payment Source

• Product

• Type

• Entered By

• Status

• Audit

• Limits

The key details for the international payment are:

![]()

· Fields marked with an asterisk (*) are mandatory.

· You can also fill in partial details, and save the transaction for later use.

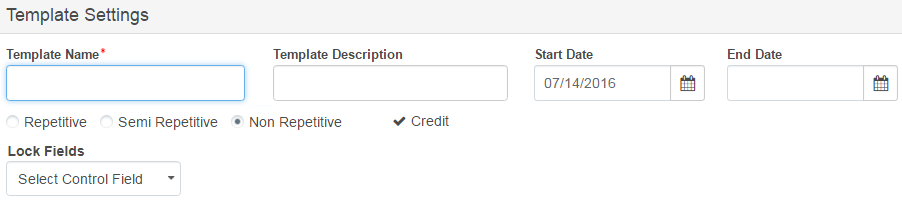

1. Specify the following template settings details:

• Template Name: Specify the name to uniquely identify the template.

• Template Description: Specify the description of the template.

• Start date: Specify the start date for the template.

• End date: Select the end date for the template.

• You can create templates, depending upon your agreement with the bank. The following types of templates can be created:

– Repetitive: The Sending Account and Receiver cannot be modified.

– Semi Repetitive: The Sending Account cannot be modified.

– Non Repetitive: The entire template can be modified.

• Lock Fields: Select the required fields to lock the same values in the template while creating transactions. Select the required locking fields from the drop-down list. You cannot edit the fields selected in lock fields when you are creating a transaction using the template.

![]() You can

select all or deselect all control fields. To lock additional fields,

select the required control fields.

You can

select all or deselect all control fields. To lock additional fields,

select the required control fields.

• Credit: The nature of the transactions such as Credit is displayed on the page based on the selected product.

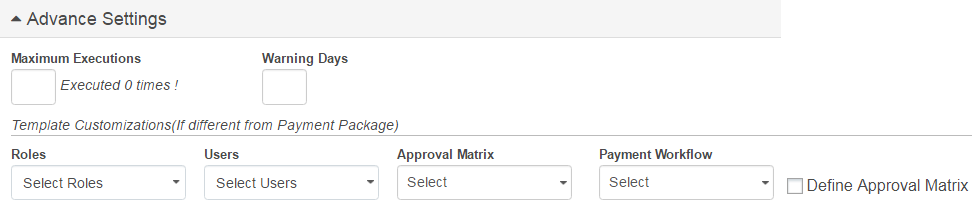

2. Specify the following details:

– Maximum Executions: Specify the maximum number of times the template can be executed. The template becomes inactive after the specified executions are done.

– Warning Days: Specify the number of days prior to which a warning must be displayed, if you are creating another transaction using the same template.

![]() If a transaction is created by using

the template on 16th August and warning days are set as 10 days, a warning

is displayed if you try to create another transaction before 26th August.

If a transaction is created by using

the template on 16th August and warning days are set as 10 days, a warning

is displayed if you try to create another transaction before 26th August.

• If you want to customize the template (If different from Payment Package), specify the following details:

– Roles: Select the required roles.

– Users: Select the required users.

– Approval Matrix: Select the approval matrix.

– Payment Workflow: Select the required payment workflow.

– Define Approval Matrix: Select the check box to create an approval matrix for the template. For more information, see Creating approval matrix for a template.

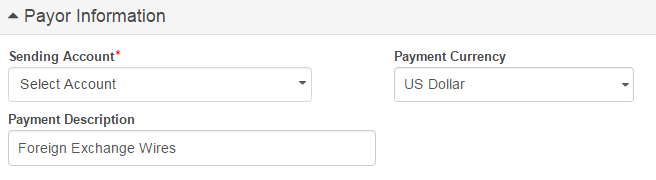

3. Specify the following payor information:

• Sending Account: Select the required sending account from drop-down.

![]() You can

select all or deselect all sending accounts.

You can

select all or deselect all sending accounts.

• Payment Currency: Select the required payment currency from drop-down.

• Payment Description: The payment description is auto-displayed.

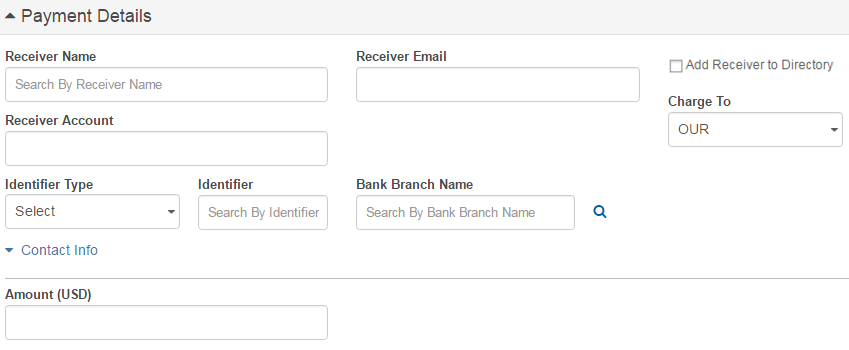

4. You can choose to make a payment to a registered receiver or and adhoc receiver.

Registered Receiver

Register Receiver option allows user to make the payment to pre-defined receivers.

1. Search and select the required receiver name from the list. The Receiver Email, Receiver Account, Currency, Account Type, Identifier Type, Identifier, and Bank Branch Name fields are auto-displayed. Also, the Contact Information such as receiver's address details, receiver's correspondent details, intermediary bank details are auto-displayed. The Switch to Adhoc Receiver link appears on the page.

2. Specify the following details:

• Amount: Specify the payment amount.

• Charge To: Select the required option in Charge To field. The available options are Select Charge To, BEN and OUR.

For additional details see more receiver information.

Adhoc receiver

1. If the receiver does not exist in Fusion Cash Management (FCM), you can

specify the required receiver details.

2. Also, specify the Contact Information such as receiver's address details, receiver's bank address details, receiver's correspondent details, intermediary bank details.

For field level details, see Adding a Receiver.

![]()

· You can also choose to save this ad-hoc receiver information in FCM for future use. Select the Add Receiver to Directory check box and specify the Receiver Short Code.

· Click here to view the special characters allowed for the Receiver Name field.

3. You can choose to make a payment to a registered ordering party or an adhoc ordering party.

Registered ordering party

Select the name of the ordering party. Details such as the Ordering Party Email ID, Ordering Party ID, Address, Country, State, City, and ZIP Code, contact details, Tag 50a information line 1 to 4 is auto-displayed for a registered ordering party.

Also, the Additional Information, Regulatory Information, Swift Information, and Swift Instruction is auto-displayed depending on product setup.

Reference information such as Debit and Credit Reference, Debit and Credit Description, and Purpose Code are auto-displayed depending on product setup. The Switch to Adhoc Ordering Party link appears on the page.

Adhoc ordering party

If the ordering party does not exist in FCM, you must specify the required details about the ad-hoc ordering party.

![]() You can also save this ad-hoc ordering

party information in FCM for future use. Select the

Add Ordering Party to Directory check box.

You can also save this ad-hoc ordering

party information in FCM for future use. Select the

Add Ordering Party to Directory check box.

For field level details, see Adding an Ordering Party.

Specify Contact Information, Additional Information, Regulatory Information, Swift Information, and Swift Instruction.

Also, specify Reference information such as Debit and Credit Reference, Debit and Credit Description, and Purpose Code.

• Provide the following additional details about the payment:

– Specify the Address, Fax No., Mobile No., and Telephone No.

– Specify the IVR Code.

– Specify the information line in Tag 50a information Line 1 to 4. Tag 50a information Line 1 to 4 auto-populate the information from field Ordering party ID, Address, Country, City, State, Zip Code. Line1 auto-populate with Ordering party ID, Line 2 and Line 3 auto-populate with field address and line 4 auto-populate with Country, City, State, and Zip Code.

• Select the Additional Information check box. Provide the following additional information about the payment:

– Specify any additional information about the transaction in Additional info.

• You can specify information that must be sent to the bank using Bank to Bank information. You have the following option:

– Instructions are for the account with the financial institution. Specify the instruction using Text field.

– The instruction institution which instructed the payor to execute the transaction.

– Instructions for the intermediary.

– Instructions for receiver.

– You can continue to use the remaining fields for additional information.

• You can also specify the instruction using Instruction Code.

– Select the required instruction code and add the instruction in the text field.

Click Next to save the details and proceed to the Verify Template page.

![]() Verifying

and submitting a payment template

Verifying

and submitting a payment template

| © 2017-19 Finastra International

Limited, or a member of the Finastra group of companies (“Finastra”).

All Rights Reserved.

Cat ID: FCM4.6-00-U02-1.5.3-201903 |